PZU Group’s Capital and Dividend Policy

Equities and Bonds

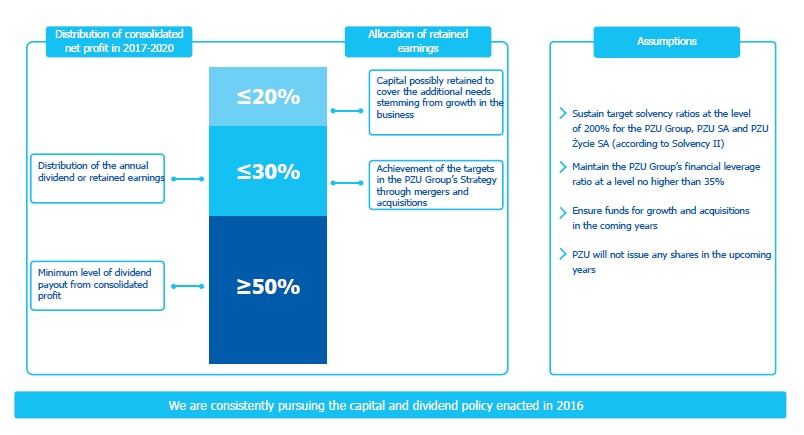

On 3 October 2016 PZU Supervisory Board adopted a resolution (Current Report 61/2016 of 4 October 2016) to approve the PZU Group’s Capital and Dividend Policy for 2016- 2020 (“Policy”).

The introduction of the Policy followed from implementation, as of 1 January 2016, of Directive 2009/138/EC of the European Parliament and of the Council of 25 November 2009 on the taking-up and pursuit of the business of insurance and reinsurance (“Solvency II”), as amended, the Insurance and Reinsurance Activity Act of 11 September 2015 and the expiration of the PZU Group’s Capital and Dividend Policy for 2013-2015 updated in May 2014.

In accordance with the Policy, the PZU Group endeavors to do the following:

- manage capital effectively by optimizing the usage of capital from the Group’s perspective;

- maximize the rate of return on equity for the parent company’s shareholders, in particular by maintaining the level of security and retaining capital resources for strategic growth objectives through acquisitions;

- ensure sufficient financial means to cover the Group’s liabilities to its clients.

The capital management policy rests on the following principles:

- the PZU Group’s capital management (including excess capital) is conducted at the level of PZU as the parent company;

- sustain target solvency ratios at the level of 200% for the PZU Group, PZU and PZU Życie (according to Solvency II);

- maintain the PZU Group’s financial leverage ratio at a level no higher than 35%;

- ensure funds for growth and acquisitions in the coming years;

- PZU will not issue any new shares for the duration of this Policy.

The PZU and PZU Group’s dividend policy rests on the following principles:

- The PZU Group endeavors to manage capital effectively and maximize the rate of return on equity for the parent company’s shareholders, in particular by maintaining the level of security and retaining capital resources for strategic growth objectives through acquisitions;

- the dividend amount proposed by the parent company’s Management Board which PZU pays for a given financial year is determined on the basis of the PZU Group’s consolidated financial result attributable to the parent company, where:

- no more than 20% will be earmarked as retained earnings (supplementary capital) for goals associated with organic growth and innovations as well as execution of growth initiatives;

- no less than 50% is subject to payment as an annual dividend;

- the remaining part will be paid in the form of annual dividend or will increase retained earnings (supplementary capital) if in the given year significant expenditures are incurred in connection with execution of the PZU Group Strategy, including in particular, mergers and acquisitions;

with a reservation that:

- according to the Management Board’s plans and risk and solvency self-assessment of the parent company, the own funds of the parent company and the PZU Group following the declaration or payment of a dividend will remain at a level that will ensure fulfillment of the conditions specified in the capital policy;

- when determining the dividend the regulatory authority’s recommendations concerning dividends will be taken into consideration.

PZU Group’s Dividend and Capital Policy

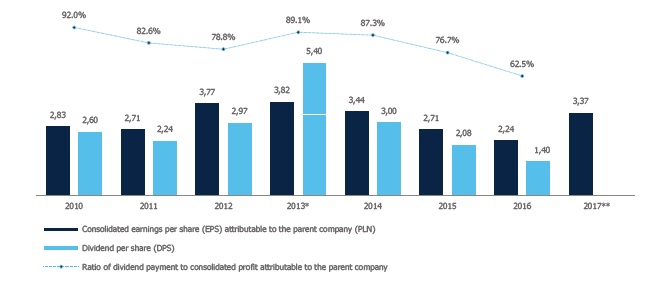

PZU’s earnings and dividend per share in 2010 - 2017

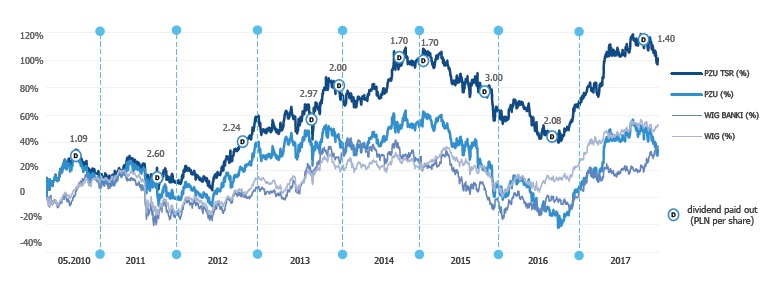

Dividend distributions and total shareholder return (TSR) of PZU (2010 - 2017)

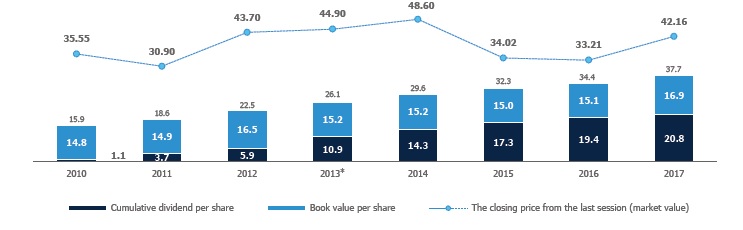

Book value per share and gross accumulated dividend per share in PZU (PLN) (2010 - 2017)

* in 2013 a dividend was paid from excess capital (PLN 2 per share)

Payment of a dividend from the profits generated in 2016

On 29 June 2017, PZU’s Ordinary Shareholder Meeting adopted a resolution to distribute PZU’s net profit for the financial year ended 31 December 2016, in which it resolved to distribute the amount of PLN 1,208,932,200, or PLN 1.40 per share, as dividend. The date on which the list of shareholders entitled to a distribution was 29 September 2017. The dividend was paid on 19 October 2017.

The Polish FSA’s recommendation on dividend payments from the profits generated in 2017

As it was the case in previous years, on 5 December 2017 the Polish Financial Supervisory Authority took a stance on the dividend policy of banks, insurance and reinsurance companies, universal pension fund companies, brokerage houses and mutual fund companies in 2018 (download).

As recommended by the supervisory authority, dividends should be paid only by insurance undertakings meeting certain financial criteria. At the same time, the dividend payments should be limited to no more than 75% of the profit earned in 2017, while the coverage of the capital requirement for the quarter in which the dividend was distributed should be maintained at no less than 110%. At the same time, the Polish FSA permits dividend distributions equal to the entire profit earned in 2017 provided that the capital requirement coverage (after expected dividends are deducted from equity) at the end of 31 December 2017 and for the quarter when the dividend is paid, is at least 175% for companies operating in section I and at least 150% for companies operating in section II.

Up to the date of preparing this Report on the activities of the PZU Group, the Management Board has not adopted a resolution concerning the distribution of profit for 2017.

Dividend paid by PZU from its earnings in the 2012 - 2017 financial years

| 2017 | 2016 | 2015 | 2014 | 2013 | |

| Consolidated profit attributable to the parent company (in PLN m) | 2910 | 1 935 | 2 342 | 2 968 | 3 293 |

| PZU SA’s standalone profit (in PLN m) | 2434 | 1 573 | 2 249 | 2 637 | 5 106 |

| Dividend paid for the year (in PLN m) | *** | 1 209 | 1 796 | 2 591 | 4 663 |

| Dividend per share for the year (PLN) | *** | 1,40 | 2,08 | 3 | 5,40** |

| Dividend per share on the date of record (PLN) | 1,40 | 2,08 | 3 | 3,4 | 4,97 |

| Ratio of dividend payment to consolidated profit attributable to the parent company | *** | 62,5% | 76,7% | 87,3% | 89,1%* |

| Dividend yield in the year ** | 3,3% | 6,3% | 8,8% | 7,0% | 11,1% |

| TSR (Total Shareholder Return) *** | 31,2% | 3,7% | -23,8% | 15,8% | 14,1% |

* dividend paid from excess capital in 2013 (PLN 2 per share) not included in dividend payment ratio

** ratio calculated as dividend as at the record date to the share price at the end of the reporting year

*** up to the date of preparing this Report on the activities of the PZU Group, the Management Board has not adopted a resolution concerning the proposed distribution of profit for 2017